How Much Money Can I Make At Age 66 While On Social Security

Note: The Social Security earnings limit changes each year. The most current version of this article uses numbers for 2022.

At i of my first speaking engagements, I heard a not bad story from one of the attendees. Her experience provides us with one of the best examples I've always heard of how much the Social Security income limit can catch you by surprise.

A few years earlier, she'd been at her bridge lodge when the topic turned to Social Security. Equally she and the other menu players chatted virtually the best way to leverage Social Security Benefits, the consensus effectually the table seemed to be that filing at 62 was the smartest thing to do.

This lady, trusting the advice of some of her closest friends, did just that: She filed for benefits as soon as she turned 62.

She then told me she'd always wanted to buy a brand-new Toyota Camry. She figured that, once she started receiving Social Security income, it would be the perfect time to buy the car. She was nonetheless working, which meant her Social Security check would be extra income.

As she told the story to me, she bought the automobile and took out a auto loan to do it. She planned to repay the loan using some of the income she expected to receive from her Social Security benefits since she filed for them.

Imagine her surprise, so, when a nasty letter from Social Security Administration showed up in her mailbox. The letter claimed she had been paid benefits that she was non eligible for!

The Social Security Administration non only asked her to pay the benefits back, but also informed her that future benefits would be suspended due to her income.

Now she had a new auto and a car loan, without the Social Security benefits she planned to use to handle that monthly payment. What happened here?

Something that surprises more than just the poor Camry owner who approached me that day: the Social Security income limit.

What Is the Social Security Income Limit?

The earnings limit is as well known every bit the income limit, or the earnings test. The official term is "earnings test," but income limit and earnings limit are the terms that you'll hear near oftentimes.

For our purposes, know that all these terms mean the same thing — and in that location are four quick facts about the Social Security income limit that you should know before we jump all the way into explaining the exam or limit:

- Be aware that nosotros are talking about Social Security income limits for retirement benefits, not disability or SSI.

- The earnings limit on Social Security is not the same as income taxes on Social Security . Don't become the two confused!

- The earnings limit does not apply if you lot file for benefits at your full retirement age or beyond. These limits just apply to those who begin taking Social Security benefits before reaching full retirement historic period.

- The earnings limit is an individual limit. If y'all are still working, and your spouse is drawing Social Security, your earnings will not count towards their income limit .

Why Nosotros Take An Earnings Limit

Not long ago, a viewer on my YouTube channel asked me to give her a good reason why we have the Social Security earnings limit. The comments that followed showed how many viewers shared the belief that the earnings limit is unfair and should be eliminated.

In my response, I explained that the rationale behind the unabridged program of Social Security was to create a safety net. The original intent of the Social security program was not to supplement retirement income, but to go along the elderly (most of whom lost whatsoever potential long-term wealth in the Nifty Low) out of poverty.

I besides added that today's earnings limit is relatively generous compared to where the Social Security earnings limit began. The original Economic Security Bill (which is what the Social Security Act was originally called) President Roosevelt sent to Congress featured a very restrictive earnings limit.

That beak stated, "No person shall receive such old-age annuity unless . . . He is not employed by another in a gainful occupation."

Whoa! This means that if y'all had even a unmarried dollar in wages from a job, you could not collect a Social Security do good at all.

(If you're curious, you tin read more about the history of the Social Security earnings limit here.)

Thankfully, the system nosotros have in identify today allows for individuals to have some earnings from work while they are receiving a Social Security benefit.

Notwithstanding, it's very important to stay informed on the dollar amount of this limit considering information technology changes every yr.

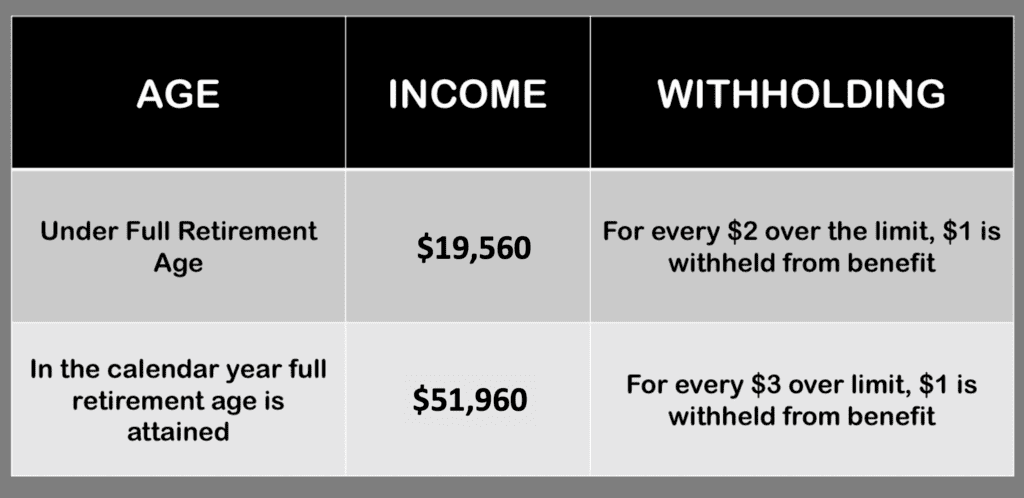

For 2022, the Social Security earning'south limit is $nineteen,560. For every $2 you exceed that limit, $i volition be withheld in benefits.

The exception to this dollar limit is in the calendar yr that you volition reach full retirement age. For the period between Jan 1 and the month you reach full retirement age, the income limit increases to $51,960 (for 2022) without a reduction in benefits. For every $3 you exceed that limit, $1 will be withheld in benefits.

This ways that if you lot have a birthday in July, you'll accept a 6 month menstruation with an increased income limit before information technology's dropped completely at your full retirement age. This increased limit and decreased withholding amount let many individuals to retire at the beginning of the calendar year in which they attain full retirement age, rather than waiting until their bodily birthdays.

Again, once you achieve full retirement historic period, there is no reduction in benefits regardless of your income level.

A Real-Life Example of the Social Security Income Limit in Action

To put these numbers into context, let'south await at an example of how this might work in a real-life scenario:

Rosie is 64 years one-time. She started taking Social Security benefits equally soon every bit she turned 62. Based on her birth yr, her full retirement age is 66.

Correct now, Rosie is eligible for $xx,000 in Social Security benefits per year. She also worked during the yr and made $29,560 in wages.

The question we want to understand is, how much was Rosie's do good reduced by working while on Social Security? To answer that, we outset demand to calculate how much Rosie was over the Social Security earnings limit for her age.

In 2021, Rosie filed for Social Security; she received her first bank check in Jan of 2022. Throughout the year she received $1,667 in benefits every month. Without knowing the rules, she also worked and earned $29,560 in wages.

With a Social Security earnings limit of $19,560, she was over by $10,000:

$29,560 Full Wages – the Social Security Income Limit of $19,560 = $x,000 Income in Excess Of Limit

Because this is a full agenda year during which Rosie is receiving benefits but is not yet full retirement age, the benefits reduction amount is $1 reduction for every $2 in excess wages. Since she was over the limit by $10,000, her benefits will exist reduced past $5,000.

The do good reduction adding would announced as follows:

$ten,000 Income in Excess of Limit x fifty% ($one reduction for every $2 over limit) equals a $5,000 Do good Reduction

With a $five,000 benefits reduction for exceeding the income limits, Rosie's $20,000 yearly Social Security benefit volition be reduced to a $15,000 benefit for the year. In the following yr she would achieve her full retirement historic period and after her altogether, the limit would no longer employ.

Special Monthly Income Limit Dominion for the Outset Year (or, Your Grace Year)

Many people who retire mid-year have already earned more than income than the limit allows. This is why there is a special rule where the earnings limit switches from an almanac limit to a monthly limit. (These monthly limits are 1/12 of the annual limit.)

This rule allows you to receive a check for any month yous are considered "retired" by the SSA even if you have already exceeded the almanac earnings limit.

That sounds straightforward enough — merely the estimation of "retired" as defined by the SSA can cause some confusion. Here'due south what they mean by this term:

Y'all are retired if your monthly earnings are ane/12 of the annual limit ($1,630 for 2022) or less and you did not perform substantial services in self-employment.

Essentially, y'all are considered retired unless yous make more than the income limit. The rule for the yr y'all accomplish full retirement age as well applies when working with the monthly limit. In this calendar yr for 2021, the limit is $iv,330 (ane/12 of $51,960).

It's very of import to remember that in the twelvemonth following this beginning yr, the monthly limit is no longer used and the earnings limit is based solely on your annual earnings limit.

How the Earnings Limit Is Applied

The nearly disruptive part of the benefit reduction due to income is how information technology'due south reflected in your monthly benefits deposits. Instead of taking out a little scrap every month, the SSA will withhold several months of benefits at a time.

If y'all predict in advance that yous will have excess earnings and written report this to the Social Security Administration, they may take a few months of benefits before you actually earn the predictable excess earnings.

For example, if your Social Security payment is $1,667 per month, and you expect to receive $29,560 in wages from your chore, the Administration would calculate that yous'll exist over your earnings limit by $10,000 and thus $5,000 in benefits should be withheld. So, they would withhold your benefit payment from January to March. In April, your checks would resume.

If yous don't report backlog income before you earn information technology, and then you take to report this information after the fact. You tin practise this when you file your income revenue enhancement return, simply the preferred method is to be proactive and phone call your local Social Security Assistants function.

If you look for the Social Security Administration to learn of your excess earnings via your taxation return, there could exist a significant gap betwixt the time you earn the excess income and the fourth dimension that they withhold your benefits. In well-nigh cases, it'south better to report the excess earnings apace so the benefits reduction occurs closer to the time you lot actually earn that extra income.

Regardless of whether your benefits are withheld in advance or in arrears, benefits withholding tin make budgeting and planning difficult, especially if you don't understand the system. Yous may need to create a carve up savings business relationship to ready some of those earnings bated to compensate for benefits withholding that volition occur in the future.

What Kind of Income Counts equally Earnings?

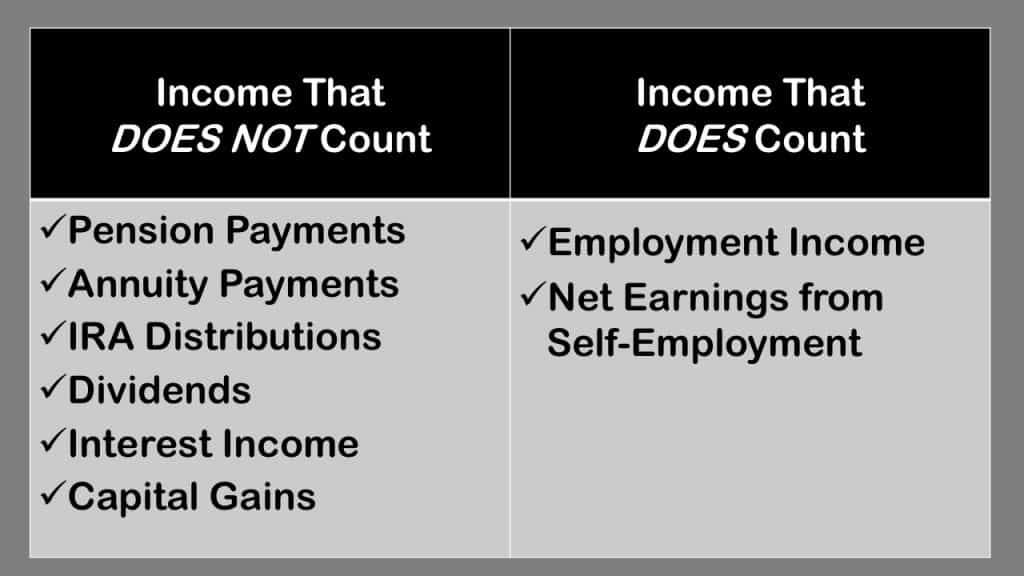

The Social Security income limit applies only to gross wages and cyberspace earnings from self-employment. All other income is exempt, including pensions, interest, annuities, IRA distributions and capital gains.

The term "wages" refers to your gross wages. This is the money that you earn before any deductions, including taxes, retirement contributions, or other deductions.

If you want to come across a more in-depth conversation nigh what counts equally income for the earnings limit, see my article on the Social Security Income Limit: What Counts as Income?

What to Do If Your Benefits Are Already Being Withheld

If yous're bailiwick to the Social Security earnings limit, don't wait for the SSA to offset reducing the do good yous receive. Instead, I'd recommend voluntarily suspending benefits.

If you wait for the Social Security Administration to discover that you've earned likewise much working while receiving benefits, your risk of an overpayment notice is higher.

Either manner, you lot aren't missing payments that you'll never get back. Your do good amount will be recalculated at your full retirement age (or when you end working) to reflect the months that benefits were withheld.

The best way to avoid the earnings limitation is to wait until total retirement age to file for benefits. If you can't wait, make sure you have a clear understanding of how working impacts your Social Security benefits.

If you still have questions, you could leave a annotate below, but what may exist an fifty-fifty greater assistance is to join my FREE Facebook members group . It'due south very active and has some really smart people who love to reply any questions yous may accept about Social Security. From time to time I'll even drop in to add together my thoughts, as well.

Yous should besides consider joining the 365,000+ subscribers on my YouTube channel ! For visual learners (as virtually of u.s.a. are), this is where I break downwardly the complex rules and help you figure out how to use them to your advantage.

1 last matter that you lot don't want to miss: Be sure to go your FREE re-create of my Social Security Cheat Canvass . This handy guide takes all of the nearly important rules from the massive Social Security website and condenses it all down to only one page.

Source: https://www.socialsecurityintelligence.com/social-security-income-limits/

Posted by: vanhoutenmiteraid.blogspot.com

0 Response to "How Much Money Can I Make At Age 66 While On Social Security"

Post a Comment